News

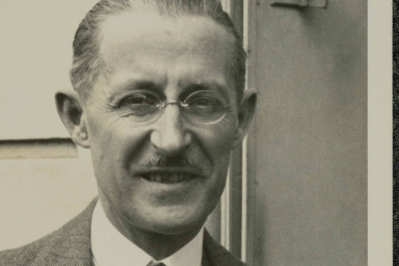

Déborah Gnagne (Master IMA, 2008), co-founder of DAYO

Déborah Gnagne, a former student of UCO, shares her journey from her early studies in mathematics to the recent establishment of the DAYO brokerage firm. Her experience at UCO prepared her for these professional challenges, and she offers valuable advice to students interested in the insurance sector. An inspiring example of success for the UCO community!

Her recent entry into the "Choiseul 100 Africa" honors her commitment among the 200 most talented African leaders under 40.

Could you introduce yourself and tell us about your academic and professional journey?

I am Déborah Gnagne, Ivorian, born in 1985. After graduating from high school in 2003, I left Côte d'Ivoire for France and obtained my DEUG in Applied Mathematics and Computer Science in Reims. I then continued at the Catholic University of the West, where I earned my bachelor's degree in Applied Mathematics in 2006 and my master's degree in Actuarial Science in 2008.I began my career in Luxembourg at an actuarial firm. My initial plan was always to return to Africa and contribute to the continent's development. In 2013, I joined a pan-African insurance group, first as the Group Actuarial Manager, then as the Technical Director for Non-Life Risks, and finally, I became the Group's Director of Business Development.

In 2019, I decided to take my career in a new direction, transitioning from being an insurer to an insurance broker. I left Côte d'Ivoire to go to Benin and eventually became the Country General Manager in one of my new employer's subsidiaries. After a few months, I was given additional regional responsibilities on top of my local duties.

You obtained your UCO degree with a Master's in Applied Mathematics in 2008. What was your experience as a student at UCO?

My experience as a student at UCO was enriching! I have very fond memories of my IMA 4 Smirnoff class. The university exchange program in Hong Kong was particularly memorable. Working in teams on projects until the early hours was a powerful experience that prepared me for the professional world.

The teaching at IMA was rigorous, and the close relationship with the professors pushed us to excel. Thanks to this demand, I acquired skills that still serve me today, especially in terms of anticipation and problem-solving.

The course on corporate sociology with Mrs. Dugué Lamy was crucial; what I learned in that course greatly helped me in managing teams at the beginning of my professional career in Africa.

The courses on algorithms and stochastic processes were also very useful. I still use mathematical methodology to build commercial and organizational strategies.

From ASK Gras Savoye to DAYO, how does your career look now?

I worked at ASK Gras Savoye for four years. I led three of its subsidiaries in Benin, Liberia, and Sierra Leone. Managing teams and a business in Africa is a challenge, but I embrace these responsibilities with enthusiasm.

Starting this October, I am embarking on a new chapter in my career by launching DAYO, a pan-African company specializing in insurance brokerage. Our goal is to become the leading insurance brokerage firm in Africa in the near future.

In your opinion, what are the development trends in the African insurance market?

The African insurance market has immense growth potential, supported by the projection of significant demographic growth on the continent by 2050. African economies are also dynamic, with six African countries among the world's top-performing economies in 2019. However, the insurance penetration rate in Africa remains among the lowest in the world.

African governments and regulators view insurance as a lever for economic and social development, leading to reforms aimed at strengthening the sector. Some insurances have become mandatory, such as construction risk insurance in Benin and health insurance. Measures have also been taken to strengthen the financial capacity of insurance companies, such as increasing the required capital in the Inter-African Conference on Insurance Markets zone.

Digitization plays a crucial role in the insurance sector, given the extensive use of telecommunications and virtual currencies (Mobile Money) on the continent. Services to policyholders are undergoing full digitization, with countries like Côte d'Ivoire and Morocco adopting digital automobile insurance certificates.

What advice would you give to current UCO students interested in pursuing a career in the insurance sector?

UCO offers valuable versatile training. Working in insurance means interacting with various sectors and collaborating with people from around the world. I advise students not to overlook any subject because to succeed in insurance, you need to be able to understand different environments and adapt to them.

Do you have a message for the UCO community?

Warm greetings to the entire UCO community! I am proud to belong to this Alumni network that successfully contributes to economic and social development in several countries around the world.

10

10